The Forward Deployed Engineer Trap

Companies are using Forward Deployed Engineers to hide a lack of PMF

One of the hottest jobs in technology today is the “Forward Deployed Engineer” (FDE). In short, an FDE is a software engineer that acts as an on-location consultant to make sure your product works exactly the way a customer needs.

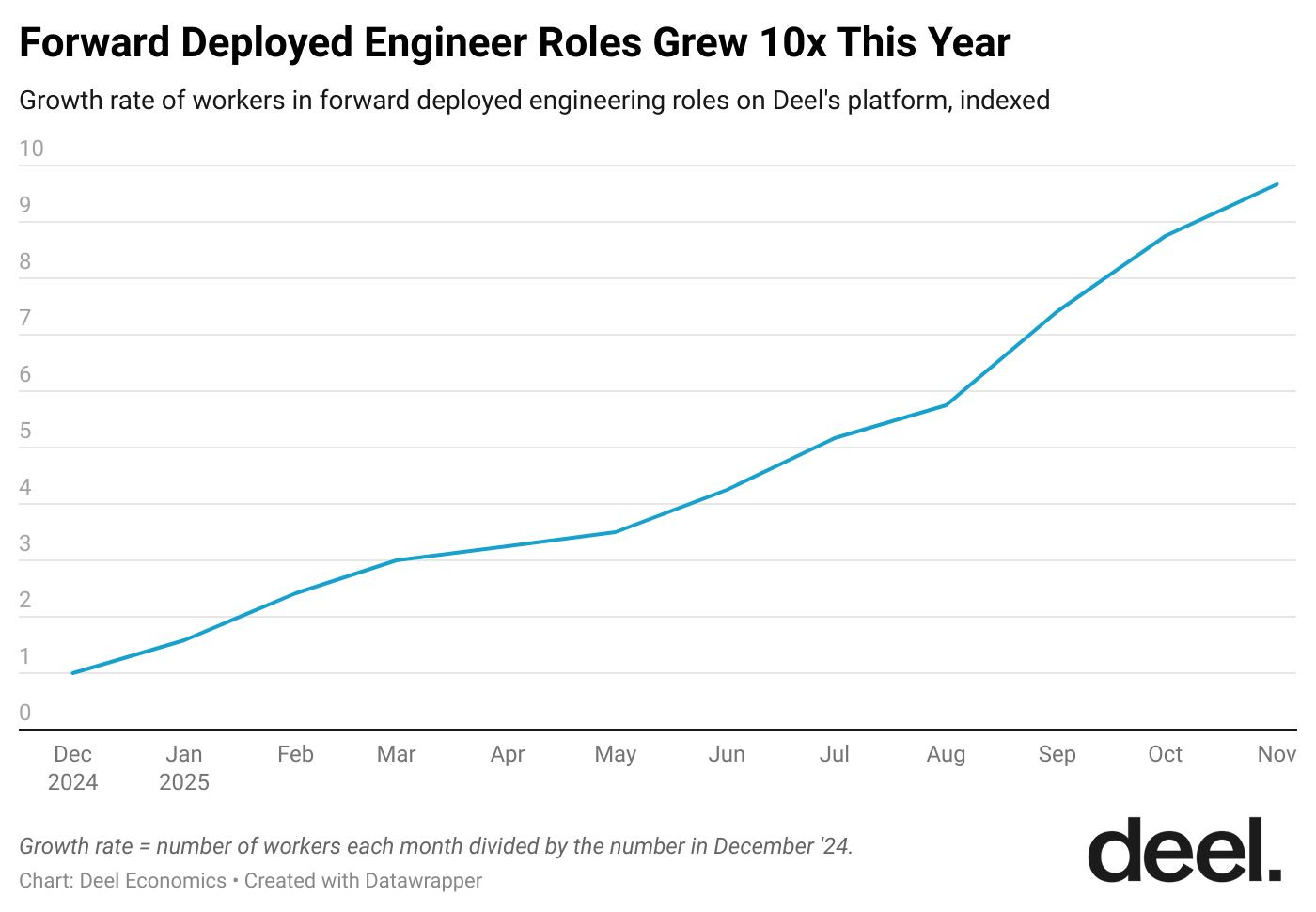

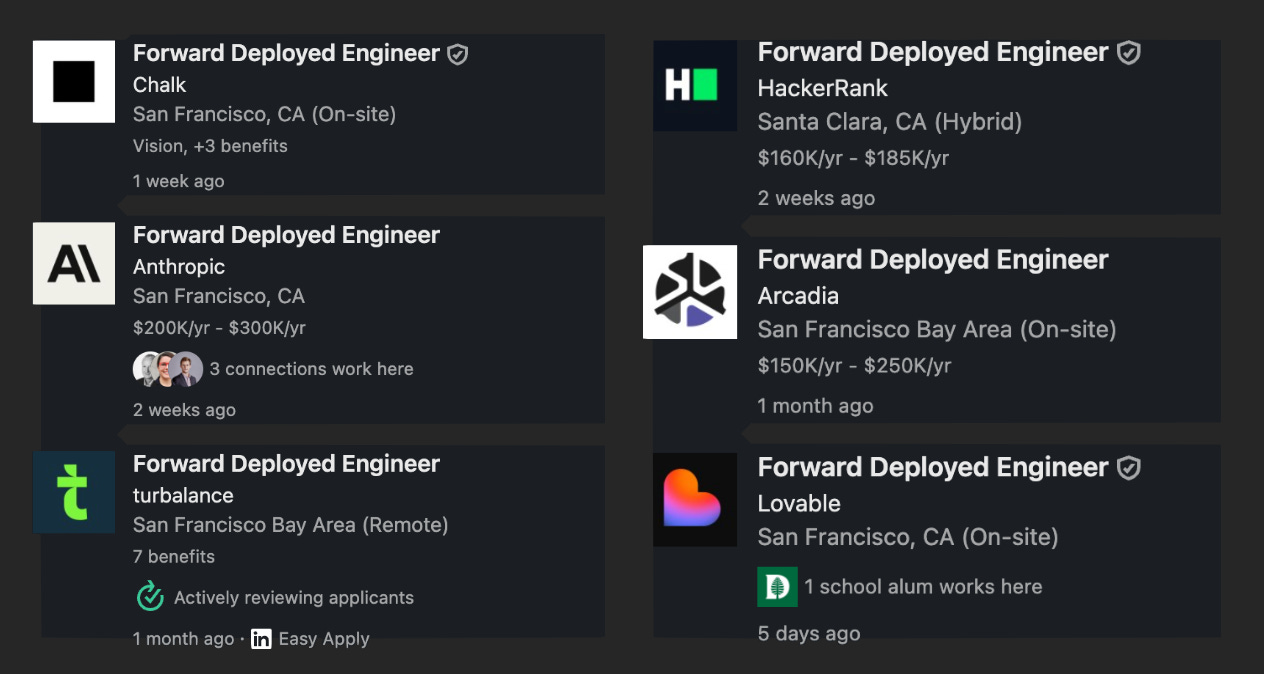

If you look at the data, job listings for FDEs have been growing rapidly across a wide swath of the industry:

Behind this growth are the armies of AI startups who need to help their customers make use of complex products and platforms. There have always been sales engineers who assist with the sales process, but they were there typically for advice and sales support. FDEs represent a person who helps with both sales, adoption, integration AND modifying the product to fit the needs of the customer. In some ways it’s a person who can do almost anything to help make sure a customer is successful.

Andreessen Horowitz believes this is a positive for the ecosystem, as services-led growth has always been necessary for certain kinds of products. This is true! There are many products where the integration is so complex that customers don’t have the tools themselves to make them work.

Here’s the catch

Unfortunately, many AI companies are using FDEs as a way to outsource their search for Product/Market Fit (PMF). PMF is generally the point at which it’s clear your business is working, customer adoption is so strong it pulls the business forward. Finding PMF is the primary goal of all new companies.

With the amount of funding flowing into early stage AI companies, the market is full of companies with huge amounts of cash but no PMF. Their product/platform has potential, but they are early and their business does not yet work well enough to justify the growth built into the valuation.

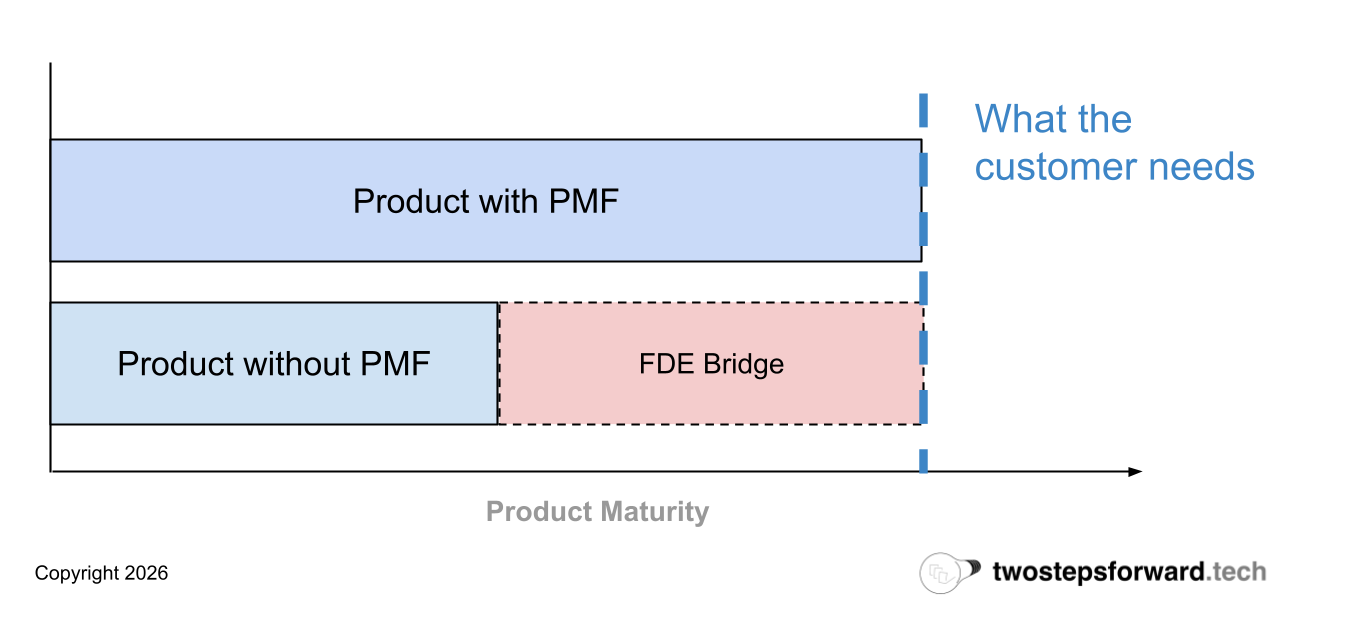

Many are hiring FDEs to bridge the gap between what their customer needs and what their product provides, using their abundant capital to create the illusion of PMF. If your product doesn’t yet solve a specific problem for the customer, an FDE can help shape it into something that does.

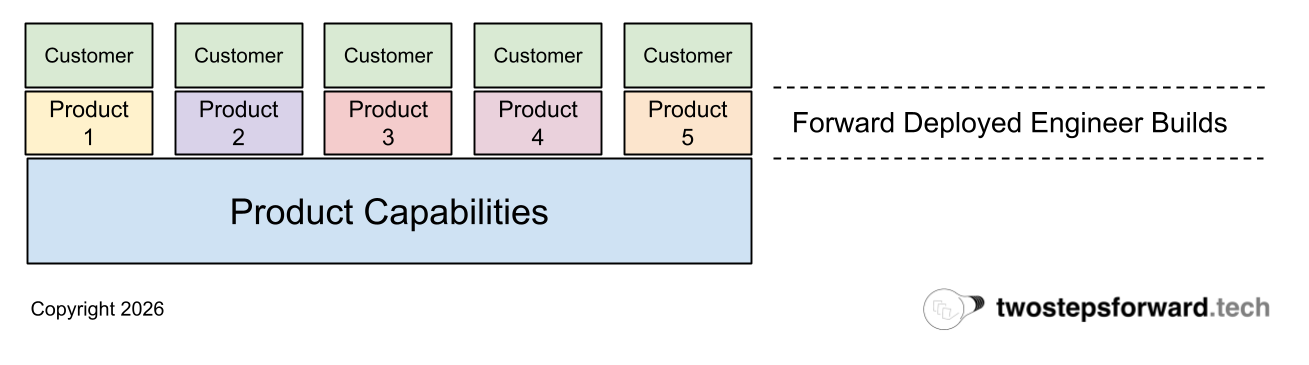

In a surprising number of these cases, the “product” is just a collection of capabilities that are combined in different ways for each customer. It’s like a buffet, where the FDE prepares meals by selecting the right foods and amounts for each person. That provides infinite flexibility, but is not a product-based business model.

There is nothing specifically wrong with this, software has been sold through Value-Added Resellers (VARs) and Systems Integrators (SIs) for decades for good reasons. Customers have a variety of needs and often customization is necessary to meet everyone’s needs.

In fact, the concept of the FDE was originated by Palantir, a company that sells data science tools to very large companies. Palantirs contracts were huge (millions of dollars) partly because every customer needed a distinct product. The Palantir FDEs built those through the basket of capabilities their platform provided and the model worked because the contract sizes were so large.

However, if your contract sizes are smaller this model doesn’t work.

Without contracts large enough to support a custom product for each, tech companies need to sell the same product to many different customers. By using a form of consulting to bridge the gap, they get farther from PMF instead of closer by assembling a potpourri of customers with no clear consistency in the sales or usage motions. Without focus and consistency it’s not possible to build a high-growth business, and by using FDEs to meet the needs of such a wide range of customers they get less focused.

Even worse, all of those bespoke customer products become more and more expensive to maintain. Product companies rely on the efficiencies gained by sharing maintenance and R&D cost across all their customers. When your customers all use different products, that efficiency is lost.

This is not a secret, and it’s clear why this is happening. With so much pressure to grow, every prospective customer (aka lead) is a golden opportunity and it’s hard to let them go. At the same time, many companies raised money before doing enough market research to be sure their product would solve a real problem. Faced with a series of leads and a product that doesn’t quite fit the problem, it’s easier to hire FDEs than tear up the foundation to address the real problem.

We see a lot of startups getting to impressive revenue levels quickly, but then hitting a plateau and having trouble growing further. They are falling into this trap. Revenue grows quickly (at low margins) but then hits a ceiling when the cost of FDEs, maintenance and distraction add up. What allowed the company to grow fast begins to hold it back.

This is another reason we see such a fast growth in the number of job listings for FDEs. If you need FDEs to close and activate customers, the more FDEs you have the faster your revenue grows. It’s like how you need to hire more salespeople to sell more.

The Bottom Line

There is nothing wrong with the FDE position if the company has PMF, as it’s just a different kind of sales process. If the company lacks PMF, then they are building a mirage that will eventually collapse when pushed far enough.

It’s likely we will see this shake out in 2026. The companies using FDE to outsource their search for PMF will not find it, and the ones that have it will continue to grow. The market will have a lot of small/medium sized AI companies that are generating revenue but struggling for venture-scale growth.